5 Eye-Opening Stats About the Financial Strain of Caregiving

Caregiving is an act of love, but for millions of Americans, it comes with a heavy financial price tag. According to the new Caregiving in the U.S. 2025 report from AARP and the National Alliance for Caregiving, nearly half of caregivers (47%) report at least one negative financial impact from their responsibilities.

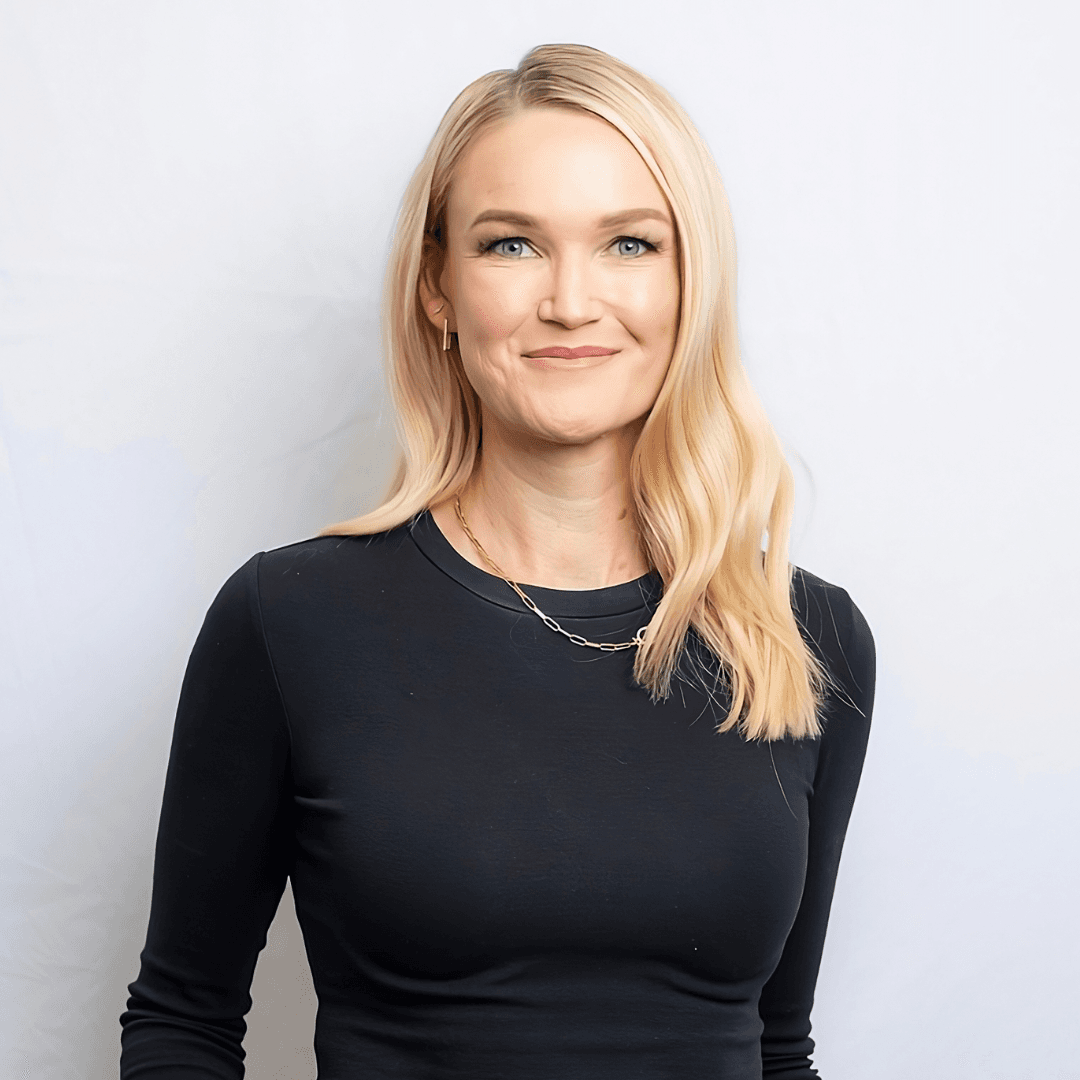

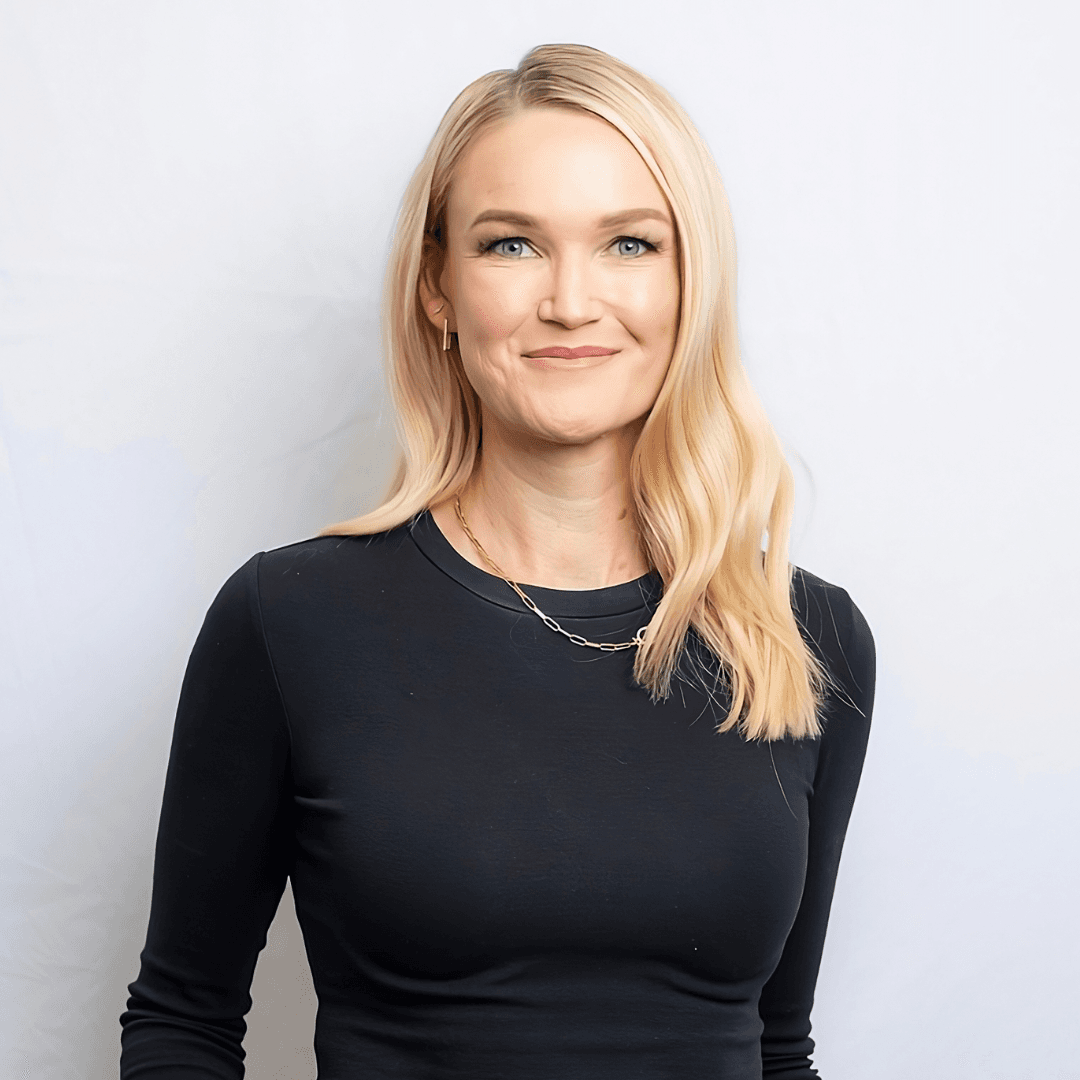

Nicole àBeckett

Published on August 20, 2025

Caregiving is an act of love, but for millions of Americans, it comes with a heavy financial price tag. According to the new Caregiving in the U.S. 2025 report from AARP and the National Alliance for Caregiving, nearly half of caregivers (47%) report at least one negative financial impact from their responsibilities.

As the number of caregivers has surged—63 million adults in 2025, up 45% since 2015—the financial ripple effects are touching more families, workplaces, and communities than ever before.

The Numbers Behind the Strain

The report reveals how deeply caregiving cuts into household stability:

31% of caregivers have stopped saving altogether

24% have used up short-term savings

23% have taken on more debt

20% left bills unpaid or paid them late

14% couldn’t afford basic expenses like food (up from 11% in 2020)

Some caregivers even reported delaying retirement, moving to cheaper housing, or experiencing eviction or foreclosure. These aren’t isolated struggles—they represent a growing national crisis.

Who Feels It Most

Financial strain isn’t evenly distributed. Certain groups are more vulnerable to long-term financial setbacks:

Younger caregivers are more likely to stop saving, use up personal savings, or fall behind on bills—threatening their future stability.

Black and Latino caregivers disproportionately face higher debt, missed bills, and food insecurity.

LGBTQ+ caregivers more often report difficulty affording basic expenses.

Lower-income families feel the harshest blows: 28% can’t afford essentials, and nearly half have had to stop saving altogether.

When caregivers already live on tight budgets, even small disruptions snowball into major crises.

The Hidden Career Costs

Caregiving also shapes lifetime earnings. Many caregivers:

Scale back hours or leave jobs entirely

Miss promotions

Put off retirement or lose access to employer benefits

Over time, this adds up to lost wages, reduced retirement contributions, and lower Social Security benefits. The report estimates that caregivers can lose hundreds of thousands of dollars in lifetime earnings as a result of these disruptions.

What Caregivers Want

The good news? Caregivers are clear about the support they need. According to the report, the top policy solutions include:

Income tax credits (69% say this would help)

Direct payment programs (68%)

Partially paid leave (55%)

Beyond financial relief, caregivers also want respite services, better training from health professionals, and emotional support resources.

Finding Relief & Connection

Financial strain doesn’t have to be shouldered alone. Communities, employers, and policymakers can step up—but so can caregivers, by finding networks of support.

That’s where HeroGeneration comes in. We’re building a space where caregivers can:

Access resources on financial planning and benefits

Learn about caregiver payment programs

Connect with others facing the same challenges

Advocate for policy changes that recognize the true cost of care

The Bottom Line

Caregiving is priceless work, but it should not come at the cost of caregivers’ financial security. With 63 million Americans now in caregiving roles, the time is now to build systems that sustain both caregivers and the ones they love.

About Nicole àBeckett

Nicole àBeckett is the founder of HeroGeneration, a platform born from her personal journey as a caregiver to her aging parents. While raising her own young family, Nicole was thrust into the complex world of hospital discharges, care decisions, and medical advocacy — all with little guidance or support. Her experience as part of the “sandwich generation” inspired her to create a resource that didn’t exist: one that empowers caregivers with clarity, tools, and community during some of life’s most overwhelming transitions. A passionate advocate and social entrepreneur, Nicole brings heartfelt stories, practical insights, and a mission to shine a light on the invisible work of caregiving. She’s on a mission to change how we support family caregivers — and to remind them they’re not alone.